Abilities Required for Machine Operators

- Ability to detect and repair malfunctions of equipment

- Ability to comprehend the functions and mechanisms of equipment and discover systematic causes of abnormalities

- Ability to comprehend the relationship between equipment and product qualities, predict deficiencies in quality and discover systematic causes of the deficiencies

- Ability to make repairs

- Ability to make changes to individual tasks, by one’s own efforts or in collaboration with related divisions, to meet the needs of the job

Skills Required for Maintenance Workers

- Skills to give instructions on the appropriate handling and daily maintenance of equipment

- Skills to make a judgment on the presence or absence of trouble in equipment

- Skills to choose and implement appropriate means of repair by discerning causes of trouble

- Skills to improve the reliability of equipment and parts, prolong their lives and control the emergence of trouble and failures (MTBF: mean time between failures)

- Skills to improve the safety of equipment and shorten the time for repairs by practices such as replacing machine units regularly (MTTR: mean time to repair)

- Skills to make full use of equipment and standardize equipment based on technical analysis

- Skills to optimize these activities by improving their cost efficiency

What is a Skill?

Five Stages of Skill

- Skill Stage 1: Being unacquainted with the skill (having never been taught the skill), lack of knowledge

- Skill Stage 2: Having theoretical knowledge of the skill Lack of training

- Skill Stage 3: Being able to exercise the skill up to a degree

- Skill Stage 4: Being able to exercise the skill with confidence: Having mastered the skill

- Skill Stage 5: Being able to instruct others (Being in full possession of the skill)

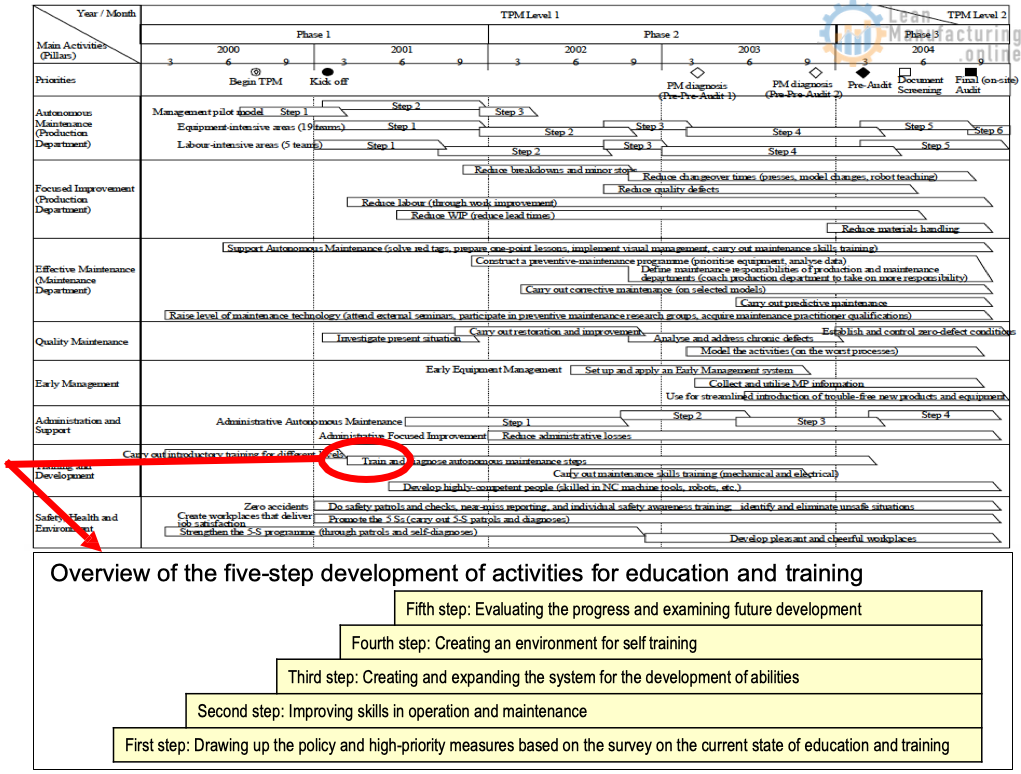

Schedule for Developing TPM Activities (Proposed)

Basic Policy for Education and Training Activities, Objectives of the Activities and High-Priority Measures (an Example)

Basic Policy

The basic policy for the education and training in this factory is to “improve the performance of our business and create worthwhile lives and jobs for individuals by improving the abilities of each employee.” It aims to help develop technical skills by providing active support for off-the-job training through on-the-job training and self-training.

Objectives

- Developing human resources well versed in equipment and office work through TPM activities.

- Developing human resources capable of meeting the needs of the workplace, based on a long-term perspective.

High-Priority Measures

We will revise the existing system for education and training and adopt the following measures as major priorities to achieve our objectives.

- Developing human resources well versed in equipment

- Training maintenance workers with higher levels of skills and ability of analysis

- Providing training courses in maintenance skills to train operators with extensive expertise in equipment

- Improving technical expertise by sending employees to outside institutes such as JIPM (Japan Institute of Plant Maintenance) for study

- Developing human resources well versed in office work. The major focus is on the gradual development of autonomous maintenance and the education for OA.

- Drawing up a program for ability development. The major focus is on the skills required for creating personnel fully capable of managing equipment and officework.

A Method of CUrriculum Developing Based on Ability Structure

CUDBAS is a method for developing curriculums based on the structure of occupational abilities.

CUDBAS 1

Preparations (introducing the participants and the basic rules)

Five or six participants are chosen from among those who are acquainted with someone well trained in the job selected for the session. It is desirable that the participants represent as many different organizational positions as possible, such as workers actually engaged in the job in question, their superiors, those who are in charge of staff training, and managers.

Precautions:

- All the participants should be accorded the same status and the same power.

- There should be no personal criticism or attacks.

- The participants should cooperate with each other to create a good list of abilities.

- The participants should try to generate and exchange ideas as flexibly as possible to create a list of the highest quality.

Introductory meeting

The participants should exchange ideas with each other for about ten minutes about a person trained in the job selected and the contents of his/her work, taking account of the following points. Memos should be written on a whiteboard if needed. These memos will serve to build up images of the job.

- What specific areas does the work of the person cover?

- How large is his/her workplace, and what kind of work is performed at the workplace? What is the job status of the person?

CUDBAS 2

Self-brainstorming (writing cards)

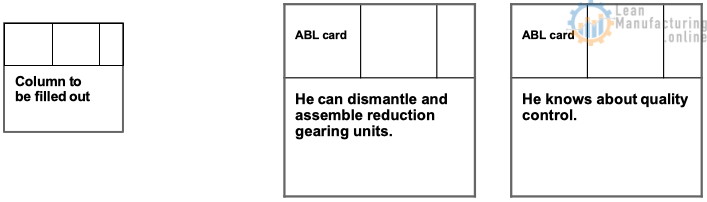

Each participant fill out cards, taking account of the points listed below. Each participant is given thirty cards. These cards are called ABL cards (Ability cards).

- What should a person trained in the job in question be able to do? Answers are stated in the form “He/She can ……”

- What should the person know? Answers are stated in the form “He/She knows ……”

- What attitude should the person able to adopt? Answers are stated in the form “He/She should be able to adopt an attitude such as ……” (Attitudes peculiar to his/her personality or personal character are excluded.)

When filling in these cards, participants are encouraged to write down whatever answers that come to mind without worrying about the possibility of the answers being the same as those of other participants. Statements should be given as precisely as possible. Each participant is expected to fill in about thirty cards. Assuming that it takes one minute to write a card, approximately thirty minutes will be required to fill out all the cards. Participants may find it hard to continue after writing a certain number of cards. In that case, thinking about the following points might help fill out the remaining cards:

Difference in job contents by situations,

- by work hours (morning, afternoon, evening and night),

- by seasons,

- by periods (such as busy times, slack times and occasions for special events),

- by states (such as emergency and accidents),

- by job partners (doing the job with difficult persons, foreigners or children).

It is known from experience that cards that contain identical answers are normally less than 10%.

Examples

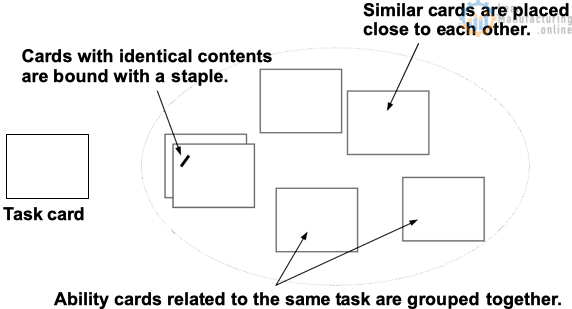

CUDBAS 3

Categorizing cards (making piles)

Participants should read their cards out loud, one by one, and put them on a table, piling them on other cards with identical or similar answers if there are any such cards, until all their cards are on the table. If there is any difference between the card read out and the similar cards on the table, it should be placed close to them (all the participants except for the card reader should show their cards on the table for others to see). The cards piled together should be checked as needed, so that the card with the most accurate description always comes on top of the pile. If no such card is found for a pile, a new card should be created to provide an appropriate description. If no problem is detected by checking the contents, cards stacked in piles should be bound with staples. Then, these cards are grouped together by “elementary task processes.” A job of a worker is normally composed of 5 to 10 elementary tasks. Cards on the table should be classified by these elementary tasks. Grouping will be facilitated by using imagination based on the descriptions in the cards without being hindered by stereotypes. Then, each task into which cards are grouped should be described on a Post-it sticker (called a “task card” below). The description must be given in the form “He does ……”

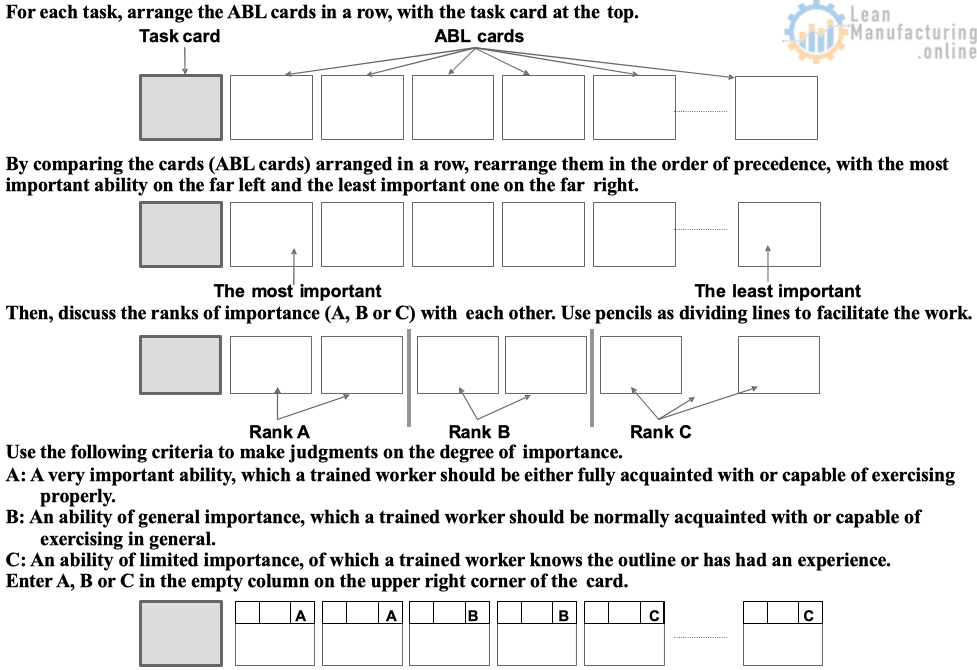

CUDBAS 4

Arranging the ability cards (according to the precedence of importance)

CUDBAS 5

Arranging the task cards (according to the precedence of importance)

Idea of Skill Evaluation, with an Example

Idea of skill evaluation

Skills are evaluated to improve the abilities of individuals and the efficiency in maintenance work by clarifying the levels of knowledge and skills required, making evaluations of individual workers, and drawing up a program for education based on the evaluations.

Curriculum and Schedules of the Introductory Training Courses on Machine Maintenance

Improving Skills in Machine Operation and Maintenance

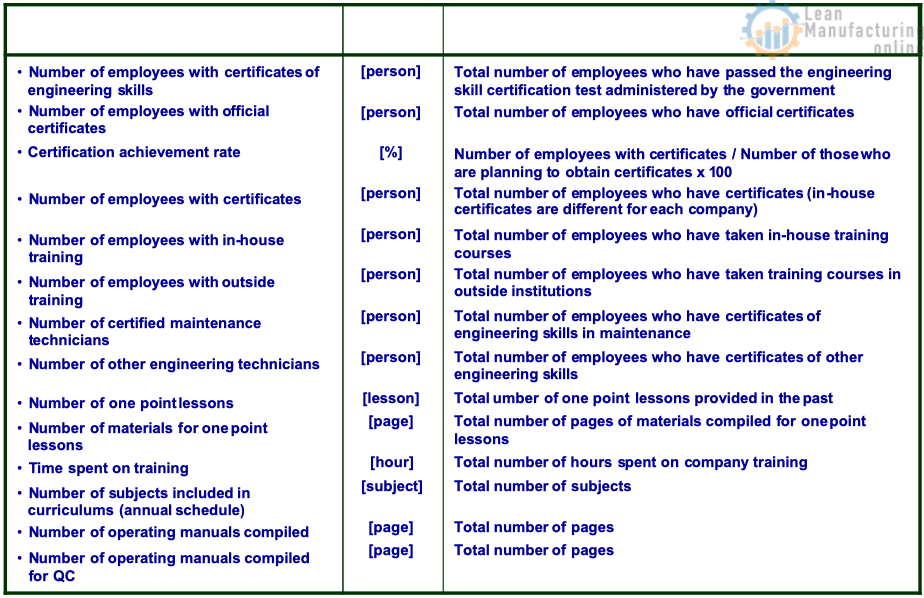

Indicators for Results and Effects of the Development of Human Resources

The effects of the development of human resources are measured by the number of employees with official certificates and engineers with officially certified skills.